A customer relationship management (CRM) system is a powerful tool that can help accountants streamline their operations, improve client service, and grow their business. CRM systems can integrate accounting software and other business applications to provide a single, comprehensive view of each client’s relationship with the firm. This information can be used to track interactions, manage communications, and automate tasks, freeing up accountants to focus on more strategic work.

CRM systems offer a number of benefits for accountants, including:

- Improved client service: CRM systems can help accountants track client interactions and preferences, so they can provide more personalized and responsive service.

- Increased efficiency: CRM systems can automate many tasks, such as scheduling appointments, sending reminders, and generating reports. This can free up accountants to focus on more value-added activities.

- Improved communication: CRM systems provide a central repository for all client communications, so accountants can easily access and share information with colleagues.

- Increased sales: CRM systems can help accountants identify and track sales opportunities, so they can close more deals and grow their business.

In today’s competitive business environment, it is more important than ever for accountants to have a strong CRM system in place. By leveraging the power of CRM, accountants can improve their client service, increase their efficiency, and grow their business.

Here are some of the main topics that will be covered in this article:

- What is CRM for accountants?

- What are the benefits of using CRM for accountants?

- How to choose the right CRM system for your accounting firm

- How to implement a CRM system in your accounting firm

- Best practices for using CRM for accountants

CRM for Accountants

A customer relationship management (CRM) system is an essential tool for accountants in today’s competitive business environment. CRM systems can help accountants streamline their operations, improve client service, and grow their business. Here are five key aspects of CRM for accountants:

- Client Management: CRM systems can help accountants track client interactions and preferences, so they can provide more personalized and responsive service.

- Sales Pipeline Management: CRM systems can help accountants identify and track sales opportunities, so they can close more deals and grow their business.

- Marketing Automation: CRM systems can automate marketing tasks, such as sending emails and scheduling appointments. This can free up accountants to focus on more strategic work.

- Reporting and Analytics: CRM systems provide robust reporting and analytics capabilities, so accountants can track their progress and identify areas for improvement.

- Integration: CRM systems can integrate with other business applications, such as accounting software and email marketing platforms. This can provide a single, comprehensive view of each client’s relationship with the firm.

By leveraging the power of CRM, accountants can improve their client service, increase their efficiency, and grow their business. For example, a CRM system can help an accountant track the status of each client’s tax return, schedule appointments, and send out reminders. This can free up the accountant to focus on more complex tasks, such as providing tax planning and consulting services.

CRM systems are an essential tool for accountants in today’s business environment. By understanding the key aspects of CRM, accountants can choose and implement a CRM system that will help them improve their client service, grow their business, and achieve their goals.

Client Management

Client management is a critical component of CRM for accountants. By tracking client interactions and preferences, accountants can provide more personalized and responsive service. This can lead to increased client satisfaction and loyalty, as well as increased revenue for the accounting firm.

For example, a CRM system can help an accountant track the status of each client’s tax return, schedule appointments, and send out reminders. This can free up the accountant to focus on more complex tasks, such as providing tax planning and consulting services. Additionally, a CRM system can help an accountant track client preferences, such as their preferred method of communication and their preferred topics of discussion. This information can be used to tailor marketing and communications efforts to each client’s individual needs.

In today’s competitive business environment, it is more important than ever for accountants to have a strong client management strategy in place. By leveraging the power of CRM, accountants can improve their client service, grow their business, and achieve their goals.

Sales Pipeline Management

Sales pipeline management is a critical component of CRM for accountants. By identifying and tracking sales opportunities, accountants can close more deals and grow their business. In today’s competitive business environment, it is more important than ever for accountants to have a strong sales pipeline management strategy in place.

A CRM system can help accountants track the status of each sales opportunity, schedule appointments, and send out reminders. This can free up accountants to focus on more complex tasks, such as providing tax planning and consulting services. Additionally, a CRM system can help accountants identify cross-selling and up-selling opportunities. For example, an accountant might identify an opportunity to sell additional services to a client who is already receiving tax preparation services.

By leveraging the power of CRM, accountants can improve their sales pipeline management, close more deals, and grow their business. Here is an example of how a CRM system can help an accountant close more deals:

An accountant is working with a new client who is in the process of starting a new business. The accountant uses a CRM system to track the status of the client’s business plan, financial projections, and loan application. The accountant also uses the CRM system to schedule regular meetings with the client to discuss their progress. By tracking the status of the client’s sales pipeline, the accountant is able to identify and address any potential roadblocks. This helps the accountant close the deal and win the client’s business.

In conclusion, sales pipeline management is a critical component of CRM for accountants. By identifying and tracking sales opportunities, accountants can close more deals and grow their business. A CRM system can help accountants improve their sales pipeline management and achieve their goals.

Marketing Automation

In the context of CRM for accountants, marketing automation plays a pivotal role in streamlining marketing efforts and enhancing client engagement. It allows accounting firms to automate various marketing tasks, including:

- Email marketing: CRM systems can automate email campaigns, including sending newsletters, promotional emails, and appointment reminders. This frees up accountants from the time-consuming task of manually creating and sending emails, allowing them to focus on more strategic initiatives.

- Appointment scheduling: CRM systems can integrate with scheduling tools to automate appointment scheduling. Clients can schedule appointments directly through the CRM system, reducing the need for phone calls and emails. This streamlines the scheduling process and saves accountants valuable time.

- Lead nurturing: CRM systems can automate lead nurturing campaigns, which involve sending a series of personalized emails to potential clients over time. This helps accountants nurture relationships with potential clients and move them through the sales funnel.

- Social media marketing: CRM systems can integrate with social media platforms to automate social media posts and track engagement. This helps accountants reach a wider audience and promote their services to potential clients.

By automating these marketing tasks, CRM systems free up accountants to focus on more strategic work, such as providing tax planning and consulting services. This can lead to increased revenue and profitability for the accounting firm.

Reporting and Analytics

Reporting and analytics are essential components of CRM for accountants. CRM systems provide robust reporting and analytics capabilities that allow accountants to track their progress and identify areas for improvement. This information can be used to make better decisions about how to manage the accounting firm and better serve clients.

For example, a CRM system can generate reports on the number of new clients acquired, the number of appointments scheduled, and the amount of revenue generated. This information can be used to track the firm’s progress over time and identify areas where improvements can be made. Additionally, CRM systems can provide insights into client behavior, such as which services are most popular and which clients are most profitable. This information can be used to develop more effective marketing and sales strategies.

Overall, reporting and analytics are essential components of CRM for accountants. By leveraging the power of CRM, accountants can gain insights into their business and make better decisions about how to manage their firm and serve their clients.

Integration

Integration is a key aspect of CRM for accountants. By integrating CRM systems with other business applications, accountants can gain a single, comprehensive view of each client’s relationship with the firm. This information can be used to provide better service, increase efficiency, and grow the business.

- Improved client service: Integration can help accountants provide better client service by giving them access to all of the relevant information about each client in one place. For example, an accountant can view a client’s contact information, financial data, and communication history all in one place. This information can be used to provide more personalized and responsive service.

- Increased efficiency: Integration can also help accountants increase efficiency by automating tasks and streamlining workflows. For example, an accountant can set up a workflow that automatically sends invoices and payment reminders to clients. This can free up accountants to focus on more value-added activities.

- Improved communication: Integration can also improve communication between accountants and clients. For example, an accountant can use a CRM system to send automated emails to clients with updates on their tax return or financial statements. This can help keep clients informed and engaged.

- Increased sales: Integration can also help accountants increase sales by providing them with better insights into their clients’ needs. For example, an accountant can use a CRM system to track client interactions and identify opportunities for cross-selling and up-selling.

Overall, integration is a key aspect of CRM for accountants. By integrating CRM systems with other business applications, accountants can gain a single, comprehensive view of each client’s relationship with the firm. This information can be used to provide better service, increase efficiency, and grow the business.

FAQs about CRM for Accountants

CRM systems can be a valuable tool for accountants, but there are also some common concerns and misconceptions about CRM. Here are answers to six frequently asked questions about CRM for accountants:

Question 1: What are the benefits of using CRM for accountants?

CRM systems can provide a number of benefits for accountants, including improved client service, increased efficiency, improved communication, and increased sales.

Question 2: How much does CRM for accountants cost?

The cost of CRM for accountants can vary depending on the size and features of the system. However, there are a number of affordable CRM systems available for small businesses.

Question 3: Is CRM for accountants difficult to use?

Most CRM systems are designed to be user-friendly and easy to use. However, some systems may require more training than others.

Question 4: Will CRM for accountants integrate with my other business applications?

Many CRM systems can integrate with other business applications, such as accounting software and email marketing platforms. This can provide a single, comprehensive view of each client’s relationship with the firm.

Question 5: How can I choose the right CRM system for my accounting firm?

There are a number of factors to consider when choosing a CRM system for your accounting firm, such as the size of your firm, your budget, and your specific needs.

Question 6: What are some tips for using CRM for accountants?

Here are a few tips for using CRM for accountants:

- Start by defining your goals for using CRM.

- Choose a CRM system that is right for your firm.

- Implement your CRM system carefully and train your staff on how to use it.

- Use CRM to track all of your client interactions.

- Use CRM to automate your marketing and sales efforts.

- Use CRM to generate reports and analyze your data.

By following these tips, you can get the most out of CRM for your accounting firm.

CRM systems can be a valuable tool for accountants. By understanding the answers to these frequently asked questions, you can make an informed decision about whether or not CRM is right for your firm.

Next: Benefits of CRM for Accountants

Tips for Using CRM for Accountants

Customer relationship management (CRM) systems can be a valuable tool for accountants. By following these tips, you can get the most out of CRM for your accounting firm:

Tip 1: Define your goals for using CRM.

Before you start using CRM, it is important to define your goals for using the system. What do you want to achieve with CRM? Do you want to improve client service? Increase efficiency? Grow your business? Once you know your goals, you can choose a CRM system that is right for you and implement it in a way that will help you achieve your goals.

Tip 2: Choose a CRM system that is right for your firm.

There are many different CRM systems on the market, so it is important to choose one that is right for your firm. Consider the size of your firm, your budget, and your specific needs. Some CRM systems are designed for small businesses, while others are designed for large enterprises. Some CRM systems are more affordable than others. And some CRM systems have more features than others. Choose a CRM system that meets the needs of your firm and that you can afford.

Tip 3: Implement your CRM system carefully.

Once you have chosen a CRM system, it is important to implement it carefully. This includes training your staff on how to use the system and setting up the system to meet your specific needs. If you do not implement your CRM system carefully, you may not get the most out of it.

Tip 4: Use CRM to track all of your client interactions.

CRM systems are a great way to track all of your client interactions. This includes phone calls, emails, meetings, and social media interactions. By tracking all of your client interactions, you can get a better understanding of your clients’ needs and provide them with better service.

Tip 5: Use CRM to automate your marketing and sales efforts.

CRM systems can be used to automate your marketing and sales efforts. This includes sending out email campaigns, scheduling appointments, and tracking leads. By automating your marketing and sales efforts, you can save time and improve your results.

Tip 6: Use CRM to generate reports and analyze your data.

CRM systems can be used to generate reports and analyze your data. This information can be used to track your progress, identify trends, and make better decisions. By using CRM to generate reports and analyze your data, you can improve your business.

By following these tips, you can get the most out of CRM for your accounting firm. CRM systems can be a valuable tool for accountants, and by using them effectively, you can improve client service, increase efficiency, and grow your business.

Next: Benefits of CRM for Accountants

CRM for Accountants

CRM systems can provide a number of benefits for accountants, including improved client service, increased efficiency, improved communication, and increased sales. By leveraging the power of CRM, accountants can gain a competitive advantage and grow their business.

Key points to remember:

- CRM systems can help accountants track client interactions and preferences, so they can provide more personalized and responsive service.

- CRM systems can help accountants identify and track sales opportunities, so they can close more deals and grow their business.

- CRM systems can automate marketing tasks, such as sending emails and scheduling appointments. This can free up accountants to focus on more strategic work.

- CRM systems provide robust reporting and analytics capabilities, so accountants can track their progress and identify areas for improvement.

- CRM systems can integrate with other business applications, such as accounting software and email marketing platforms. This can provide a single, comprehensive view of each client’s relationship with the firm.

If you are an accountant who is not currently using a CRM system, I encourage you to consider implementing one. CRM systems can be a valuable tool for accountants, and by using them effectively, you can improve client service, increase efficiency, and grow your business.

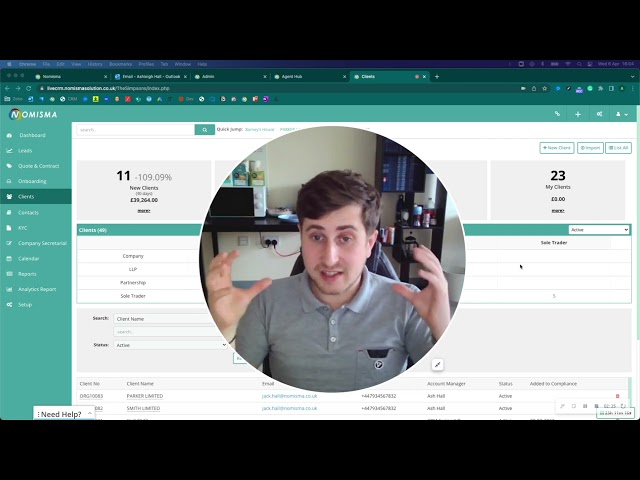

Youtube Video: